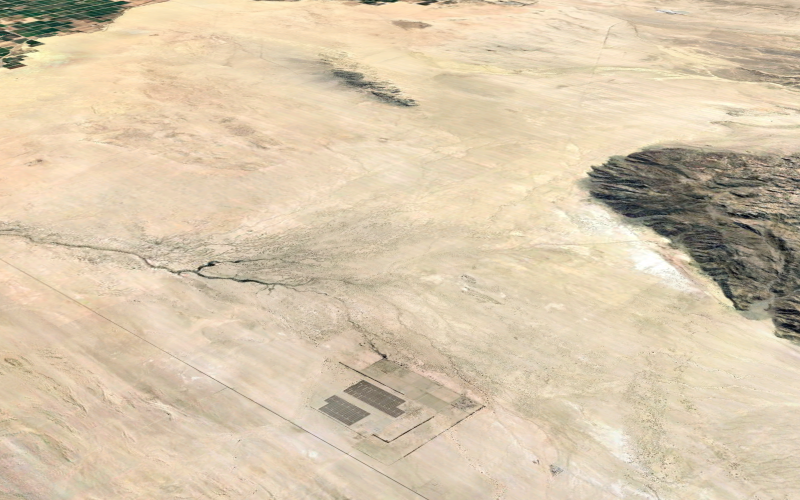

ALLEGRETTI FARMS CASE STUDY

| Property | 2,400 Acres of Farmland in Western Imperial Valley known as Allegretti Farms |

| Type of Transaction | Purchase Option |

| Term | Five Years (Three Years with 2 Extensions) |

| Final Purchase Price | $5,000,000 |

| Total Option Consideration Paid | $250,000 over 5 years |

| Total Revenue Received From Back-to-Back Options and Sale of Option | $750,000 |

| Outcome |

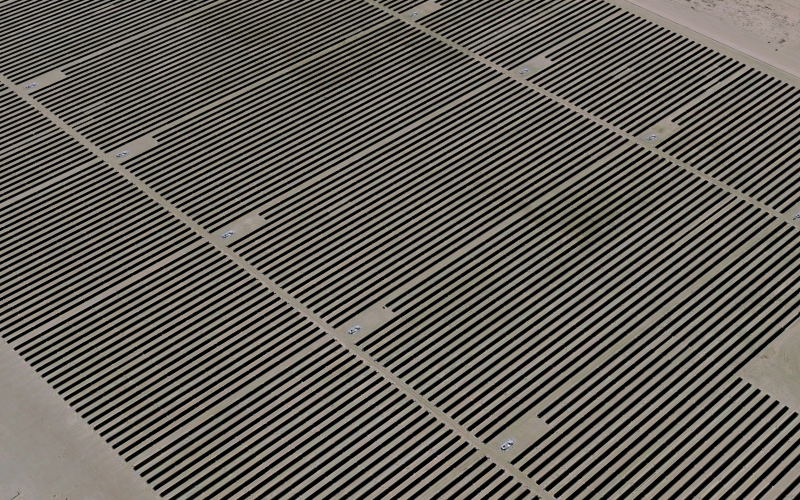

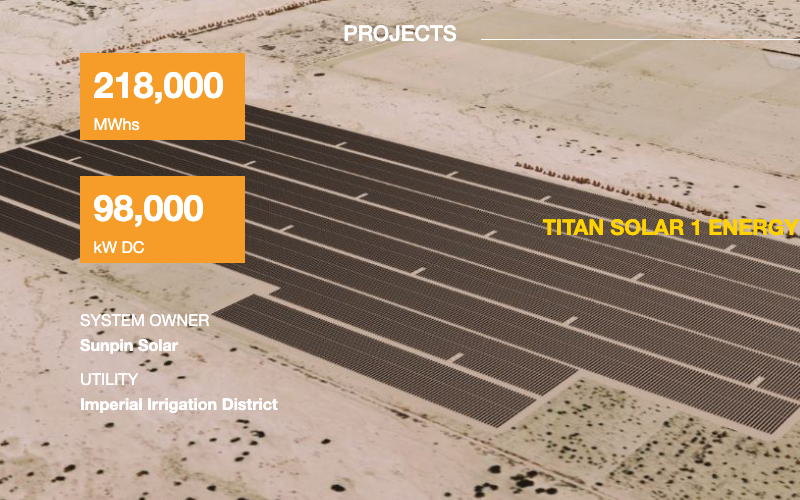

The developer (Solana Energy and AguaSol Partners) sold their option to Green Light Energy Development. This resulted in a sequence of developers handling permitting and contracting until Duke Energy Renewables acquired the project in July 2015 and then sold to Brookfield to raise needed cash. The EPC was a Canadian company, Kruger. The offtakers are San Diego Gas & Electric and the Imperial Irrigation District. The system is now a 160 Megawatt (DC) single axis array spread over 400 acres. Another 90MW phase is in planning. |

| Summary of Transaction | The transaction produced a net profit of $500,000. An alternative scenario would have been to acquire the land and then lease to a prospective solar developer. During the last year, we had a solar developer and land buyer seeking the property for a specific development and therefore we sold our position at the time for a favorable overall profit. |

| Alternative Use | Underlying the property is a significant water resource. However, the transfer of water and the rights thereto proved to be too risky to undertake. The intended beneficiary was Borrego Springs. Its water rights are now being adjudicated by the state of California. |

| Developers | Lane Sharman and Jan Stubbs as owners of Aguasol LLC and Solana Energy Farms LLC. (Now undertaking small home village development) |