Unlocking the Future of Energy Real Estate

We bridge critical timing gaps in renewable energy land development

The Timing Mismatch

Energy developers need the flexibility of 5-year options for site permitting and grid studies, while landowners often face immediate financial pressures to sell.

This critical timing mismatch means many of the most promising sites for renewable energy are permanently lost to warehouses, malls, and sprawl.

The Open Doors Solution

We identify and lock in strategic sites for energy development. With our capital partners, we strategically acquire high-potential properties when landowners need to sell.

We then structure advantageous sales or leases to leading energy developers, generating premium returns for our investment partners.

Trusted By Leading Developers

We partner with the most respected names in renewable energy

Proven Investment Results

Our strategic approach delivers exceptional returns across diverse energy storage projects

Open Doors specializes in strategic energy storage site development, generating premium returns through optimal site selection, acquisition, and structured leases or sales to top energy developers. Below are select case studies demonstrating our proven investment approach.

Solana Energy Farms aka Seville – 160MW

Solana Energy Farms Utility Scale Solar

Site Details

- 2,400 acres adjacent to IID Anza Substation (Allegretti Farms, Imperial County CA)

- Acquisition Date: January 2008

- Commercial Operation Date: December 2015

- Output: 160 MW

- Current Owner: Brookfield Renewable Partners /Deriva Energy

Investment Performance

- Development Land Purchase Option: $250,000

- Sale of Development: $750,000/4 year period

- Development Fee: $500,000

- IRR: 32%

Sullivan TN Energy Storage Site – 31.2 Acres

Sullivan, TN Energy Storage Site Lease

Site Details

- 31.2 acres adjacent to TVA 500-161kV substation

- Initial purchase: $317,100

- Lease structure: $400,000/year, 2% annual escalator

Investment Performance

- Option payments: $255,000

- Total lease revenue: $24.16M (45-year term)

- IRR: 37.73%

Ouachita Parish LA Energy Storage Site – 13.8 Acres

Ouachita Parish, LA Energy Storage Site Purchase

Site Details

- 13.8 acres next to Entergy 230kV substation

- Initial purchase: $123,930

- 13.8 acres next to Entergy 230kV substation

Investment Performance

- Option payments: $205,000

- Sale price: $738,000

- IRR: 34.43%

2001 Union Street, San Francisco

2001 Union Street, San Francisco Energy Cost Management

Site Details

- 85,000 Square Feet, Six Stories

- Commercial Sub Metered Billing of Major Tenants

- Commercial Solar & Energy Storage Installed 2018

- Building Engineering by Solana Energy

Investment Performance

- Ten Year Avoided Cost: $2,000,000

- Consumption and Demand Reduction: 35%

- 25% of PG&E Cost Recovered by Automated Billing of Tenant Sub Meter Data

- District Heating and Cooling Capital Investment Planned

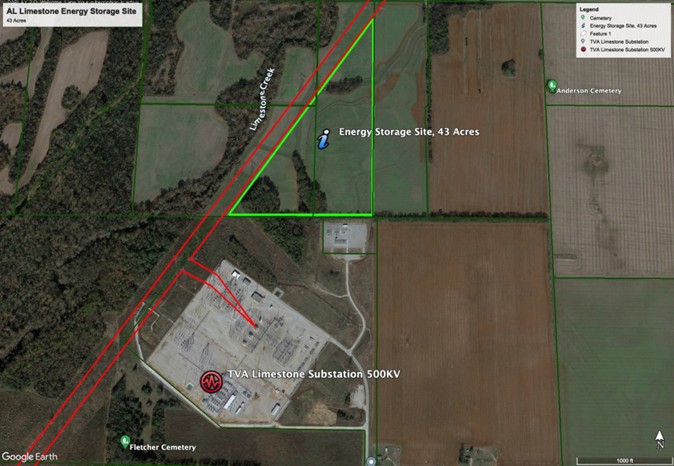

Limestone AL Energy Storage Site – 43 Acres

Limestone, AL Energy Storage Site Lease

Site Details

- 43 acres near TVA 500kV substation

- Initial purchase: $31,125

- Lease structure: $215,000/year, 2% annual escalator

Investment Performance

- Option payments: $175,000

- Total lease revenue: $8,575,853 (35-year term)

- IRR: 147%