Securing the Investment Tax Credit

What Solar Developers Need to Know Now

By Lane Sharman, Stuart Smits and Emil Botes for Open Doors Management

Maximize the ITC Before Time Runs Out

As the renewable energy landscape continues to evolve, the recently enacted tax legislation brings new deadlines into focus for solar project developers. Under the new tax law, the Investment Tax Credit (ITC) remains a critical financial incentive—but only for those who understand and act on the updated eligibility requirements.

Key Eligibility Update for Construction Start Deadline

To qualify for the ITC under the new rules, solar projects must:

- Start construction by July 4, 2026.

Projects that begin construction by this date will not be subject to the December 31, 2027 placed-in-service deadline.

Source: Norton Rose Fulbright – Effects of One Big Beautiful Bill

Critical Timeline Alert

The start-of-construction deadline is now the key eligibility factor for the ITC.

Projects that don’t begin on time risk losing access to current incentives, regardless of their placed-in-service date.

Investment Tax Credit

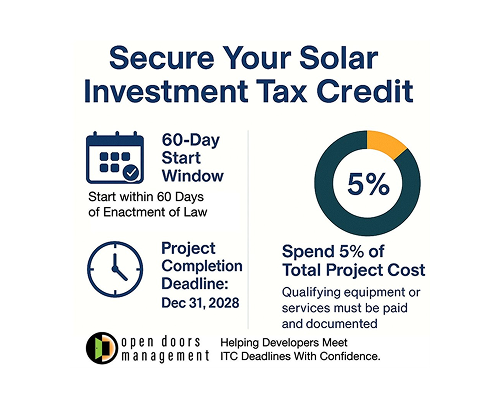

Understanding "Start of Construction:" The 5% Rule

A central component of eligibility is proving that the project has officially “started.” The IRS recognizes two methods: the Physical Work Test and the 5% Safe Harbor. Most developers opt for the latter due to its clearer financial threshold. The Physical Work Test requires clear proof of actual site construction.

What is the 5% Safe Harbor?

To meet this standard, a project owner must incur at least 5% of the total project cost on eligible expenditures in 2025. These costs must be integral to project completion — meaning they are necessary for the generation of electricity and not merely ancillary services or development fees.

📅 Upcoming Changes to Watch

By August 18, 2025, the Treasury Department is required to issue updated guidance on how “start of construction” and the 5% Safe Harbor will be interpreted under the new law. This could:

- Narrow what qualifies as eligible expenditures

- Tighten documentation or timing rules

The window for certainty is closing. Developers planning 2025 starts should act now to lock in eligibility under the current Safe Harbor rules.

Examples of Qualifying Expenditures

Project Development Services

Essential services that directly contribute to project completion and electricity generation.

Solar Equipment Purchase

Purchase of solar modules or inverters that are core to the system’s functionality.

Site-Specific Components

Site-specific engineering or racking components tailored to the project location.

Equipment Down Payments

Down payments on major equipment with binding contracts that guarantee delivery.

⚡ Critical Takeaway

The ITC remains a strong incentive but securing it requires timely action. Projects should incur 5% in qualified, paid costs in 2025 under the current Safe Harbor rules before new IRS guidance takes effect. Relying on outdated assumptions could put eligibility at risk

The Open Doors Advantage

Navigating the ITC eligibility landscape requires more than good timing – it requires strategic execution. At Open Doors Management, we specialize in guiding solar project developers through complex regulatory environments with a focus on compliance, speed, and certainty.

Contract Structuring

Structuring contracts and payment schedules to meet the 5% threshold requirements.

Cost Verification

Verifying qualifying costs and coordinating with vendors to ensure compliance.

Documentation Support

Documenting the Start of Construction for tax purposes with thorough record-keeping.

Financial Management

Managing cash flow from trust accounting to vendor disbursements seamlessly.

The Open Doors Advantage

With the countdown beginning now immediately in 2025, timing is everything. Reach out today to learn how Open Doors Management can help you secure your project’s eligibility for the ITC—and ensure your Investment Tax Credit opportunity.

Lane Sharman, President

References

IRS Deadlines Shift After New Energy Bill. Key implications for construction start requirements and Safe Harbor compliance https://www.projectfinance.law/publications/2025/july/effects-of-one-big-beautiful-bill-on-projects/

Executive Order: Ending Subsidies for “Foreign-Controlled” Renewables. July 2025 order phases out tax credits for certain wind and solar projects, with new IRS rules on the way. https://www.whitehouse.gov/presidential-actions/2025/07/ending-market-distorting-subsidies-for-unreliable-foreign%E2%80%91controlled-energy-sources/

H.R. 1 – One Big Beautiful Bill Act. (2025, May 15). House of Representatives Committee on Rules. https://rules.house.gov/bill/119/hr-ORH-one-big-beautiful-bill-act

Beginning of Construction for Sections 45 and 48; Extension of Continuity Safe Harbor to Address Delays Related to COVID-19 and Clarification of the Continuity Requirement Notice 2021-41. Retrieved June 1, 2025, from: https://www.irs.gov/pub/irs-drop/n-21-41.pdf

Beginning of Construction for Purposes of the Renewable Electricity Production Tax Credit and Energy Investment Tax Credit. (2013). Retrieved June 1, 2025, from: https://www.irs.gov/pub/irs-drop/n-13-29.pdf

Safe Harbor Extended for Energy Credits for Qualified Projects | Tax Notes. (2020). Retrieved June 1, 2025, from: Tax Notes Research

A Closer Look at the House Ways and Means Budget Reconciliation Legislation–Process and Policies. (2025). Klgates.com. Retrieved June 1, 2025, from: K&L Gates Analysis