Our Proven Energy Real Estate Track Record

Open Doors Management is revolutionizing the energy development landscape by creating valuable partnerships that benefit both landowners and developers.

Proven Investment Results

Our strategic approach delivers exceptional returns across diverse renewable energy projects

Open Doors specializes in strategic renewable energy site origination and acquisition, generating premium returns through optimal site identification and analysis, acquisition, and structured leases or sales to top energy developers. Below are select case studies demonstrating our proven investment approach.

Hampden MA Energy Storage Site – 6.72 Acres

Hampden, MA Energy Storage Site Lease

Site Details

- 6.72 acres in proximity to 115kV substation

- Initial purchase: $1,650,000

- Lease structure: $228,000/year, 2% annual escalator

Investment Performance

- Option payments: $228,000

- Total lease revenue: $7,302,908M (25-year term)

- IRR: 17.6%

Sullivan TN Energy Storage Site – 31.2 Acres

Sullivan, TN Energy Storage Site Lease

Site Details

- 31.2 acres adjacent to TVA 500-161kV substation

- Initial purchase: $317,100

- Lease structure: $400,000/year, 2% annual escalator

Investment Performance

- Option payments: $255,000

- Total lease revenue: $24.16M (45-year term)

- IRR: 37.73%

Ouachita Parish LA Energy Storage Site – 13.8 Acres

Ouachita Parish, LA Energy Storage Site Purchase

Site Details

- 13.8 acres next to Entergy 230kV substation

- Initial purchase: $123,930

- 13.8 acres next to Entergy 230kV substation

Investment Performance

- Option payments: $205,000

- Sale price: $738,000

- IRR: 34.43%

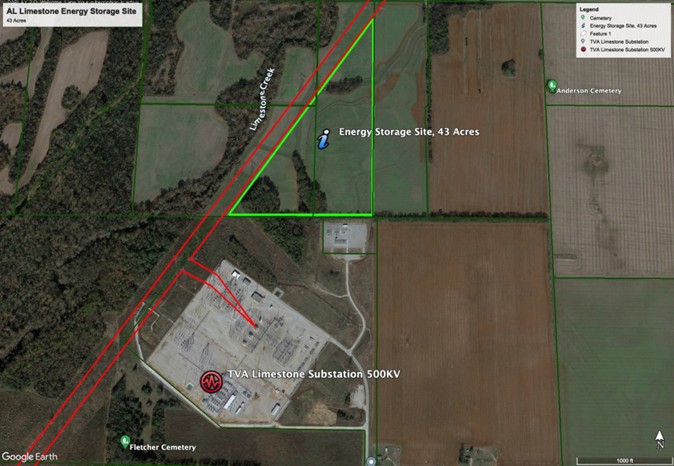

Limestone AL Energy Storage Site – 43 Acres

Limestone, AL Energy Storage Site Lease

Site Details

- 43 acres near TVA 500kV substation

- Initial purchase: $31,125

- Lease structure: $215,000/year, 2% annual escalator

Investment Performance

- Option payments: $175,000

- Total lease revenue: $8,575,853 (35-year term)

- IRR: 147%

Solana Energy Farms aka Seville – 160MW

Solana Energy Farms Utility Scale Solar

Site Details

- 2,400 acres adjacent to IID Anza Substation (Allegretti Farms, Imperial County CA)

- Acquisition Date: January 2008

- Commercial Operation Date: December 2015

- Output: 160 MW

- Current Owner: Brookfield Renewable Partners /Deriva Energy

Investment Performance

- Development Land Purchase Option: $250,000

- Sale of Development: $750,000/4 year period

- Development Fee: $500,000

- IRR: 32%

2001 Union Street, San Francisco

2001 Union Street, San Francisco Energy Cost Management

Site Details

- 85,000 Square Feet, Six Stories

- Commercial Sub Metered Billing of Major Tenants

- Commercial Solar & Energy Storage Installed 2018

- Building Engineering by Solana Energy

Investment Performance

- Ten Year Avoided Cost: $2,000,000

- Consumption and Demand Reduction: 35%

- 25% of PG&E Cost Recovered by Automated Billing of Tenant Sub Meter Data

- District Heating and Cooling Capital Investment Planned

Investor Assets

Landowners enjoy long term cash flows from rent paid by the developer to the landowner less a percentage paid to Open Doors.

Open Doors specializes in strategic energy site analysis before ever contacting a landowner. We achieve premium returns through optimal site selection, acquisition, and structured leases or sales to top energy developers. Below is a select asset in our portfolio.

Prospect Solar & Battery Project Weld County Colorado – 1,578 Acres

Project: Prospect. Obligor and Developer (confidential)

Site Details

- 1,578 Acres, 4 Distinct Landowners

- Lease Rate Per Acre $800 2% Escalator

- 3 Years Remaining on Option Period. Material On Order

- Fully Permitted. Interconnection Agreement Executed

Asset Performance

- Total Payments to Open Doors $6,471,682

- Contractual Term Remaining 43 Years

- Annual Payment, Next 15 Years $102,013

- Net Present Value $2,530,000

Janus Solar & Battery Project Weld County Colorado – 623 Acres

Project: Janus. Obligor and Developer (confidential)

Site Details

- 623 Acres, 3 Distinct Landowners

- Lease Rate Per Acre $800 2% Escalator

- 3 Years Remaining on Option Period. Land Permit Complete

- Interconnection Agreement Pending

Asset Performance

- Total Payments to Open Doors $2,457,033

- Contractual Term Remaining 43 Years

- Annual Payment, Next 15 Years $40,696

- Net Present Value $737,980

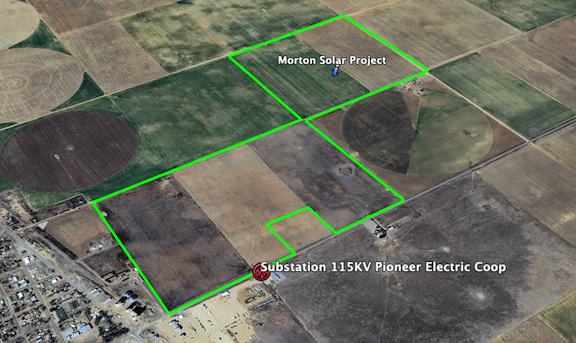

Morton Solar Project Morton County Kansas – 382 Acres

Project: Morton Solar. Obligor and Developer (confidential)

Site Details

- 623 Acres, 3 Distinct Landowners

- Lease Rate Per Acre $400 2% Escalator

- Developer Requesting 3 Year Extension

- Interconnection Agreement Pending

Asset Performance

- Total Payments to Open Doors $745,412

- Contractual Term Remaining 40 Years

- Annual Payment, Next 15 Years $14,122

- Net Present Value $247,727

Hear from Our Landowner Partners

"Working with Open Doors turned out great for me. At first, I wasn't sure about using my land for battery storage, but it's been a win-win. By leasing parts of my land, I've secured generational income for my family. Plus, the developer will restore everything once the lease is done."

"Open Doors Management saw the opportunity with our land near a substation and guided us through the process of finding a reliable tenant. They found a solid energy developer, and we feel great about leasing to a reliable team committed to making this project happen."

"After getting offers from several developers, we realized we needed an experienced energy site acquisition specialist to evaluate our land’s potential for battery storage and bring it to the right developers. That’s why we partnered with Lane Sharman and Open Doors Management. Their work led us to secure an option agreement with a leading battery storage developer."