Industrial Energy Supply Deficiency

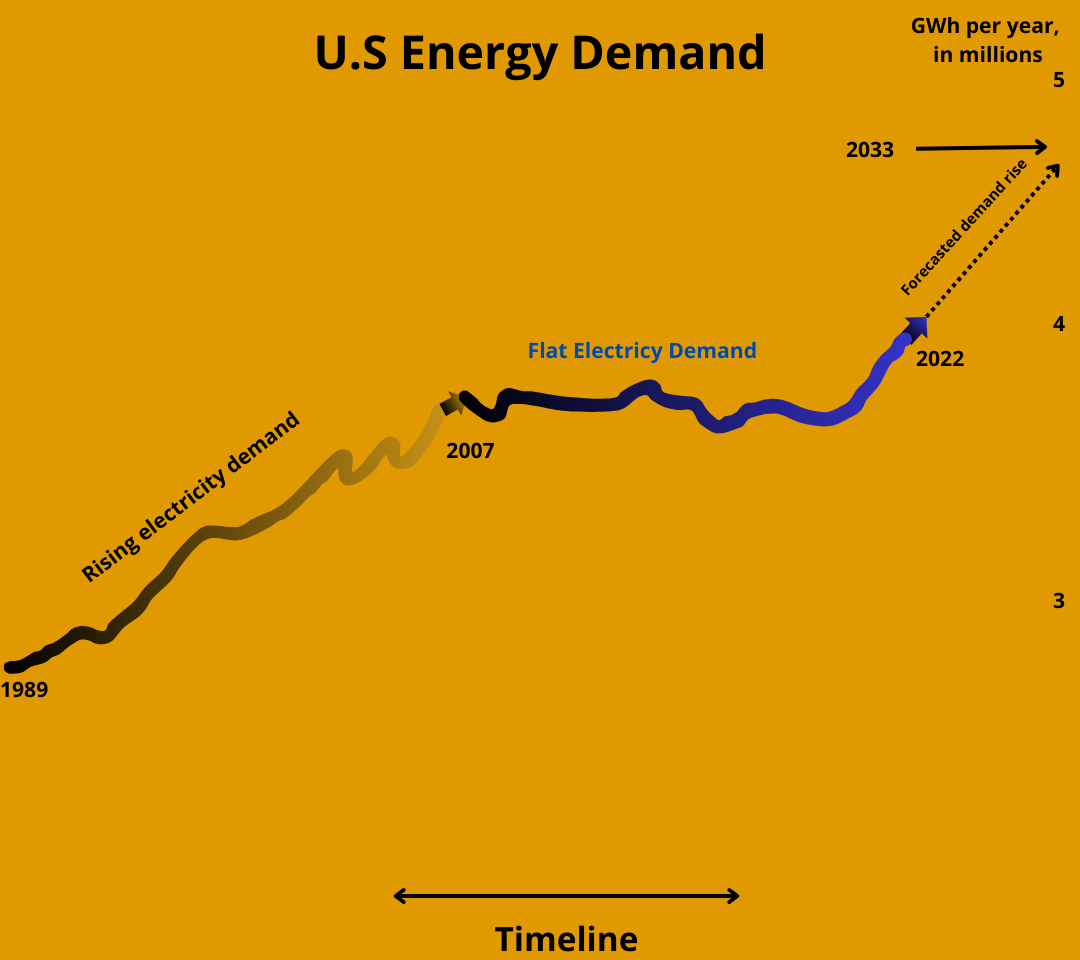

The United States power grid is being pushed to its limits.

Demand for electricity has stayed largely flat for two decades, and now begun to surge.

Large areas of the United States face the threat of power shortages as the rapid growth of energy-intensive operations overwhelms the existing electrical infrastructure, forcing utilities and regulators to urgently seek strategies for enhancing the nation’s overburdened infrastructure and generation mix.

In 2023, electric utilities have almost doubled their power demand projections for 2028, facing a surge in data center growth, a sudden manufacturing boom spurred by the Inflation Reduction Act, and the rapid increase of electric vehicles coming online.

In Georgia,

industrial power demand is soaring, projected to increase 17-fold within the next decade. This surge, driven by data centers and clean-technology manufacturers, has caught utilities like Georgia Power by surprise, revealing significant underestimations.

With Georgia Power nearing capacity limits, Georgia is now grappling with balancing the energy demands of its growing clean manufacturing industry against the capacity constraints and the need to protect ratepayers from rising costs.

In Northern Virginia,

one of the country’s largest data center hubs, has seen the opening of 75 new data centers since 2019. To support the AI Data boom, the state needs to launch the equivalent of several large nuclear power plants. Dominion Energy, anticipates that data center energy consumption could double within the next five years.

In Kansas,

The local utility Evergy announced in 2022 that it would retire its coal plant in Lawrence and add 700 MW of solar power by the end of 2024. That has been pushed back to 2028.

Now, Evergy does not plan to add any solar power until 2026 and will keep the Lawrence coal plant open until 2028.

The utility is facing increasing electricity demands and changes from the Southwest Power Pool, the regional grid, while new renewable energy projects are hampered by supply chain issues and long approval processes.

This is not just happening in Kansas. Surging energy demands are postponing the shutdown of coal plants in Nebraska, Wisconsin, and South Carolina.

The construction of data centers contrasts sharply with the extended timelines for integrating renewable energy projects into the grid, which can take five to ten years. Moreover, the continuous power needs of data centers and factories underscore the limitations of wind and solar energy’s intermittent nature, pointing to a significant gap in meeting the 24/7 power demand.

Utilities are highlighting a critical bottleneck: the slow pace of renewable energy development, hindered by permit delays and supply chain complications, necessitates reliance on fossil fuel capacity.

This new energy landscape is rapidly becoming a complex reality all over the United States. Bottlenecks in economic development, delays in energy hookups, and a competitive scramble for power sources is pushing the boundaries of conventional energy supply chains.

For businesses engaged in energy-intensive operations, depending increasingly on an outdated and overstressed electrical grid, which is already struggling to support the expansion of data centers and clean manufacturing, is becoming increasingly risky.

In Oregon,

Portland General Electric has doubled its electricity demand forecast for the next five years due to data center growth and industrial expansion.

Facing uncertainty from the utility for sufficient power supply, one data center developer in Portland is turning to off-the-grid solutions – using high-tech fuel cells that convert natural gas into low-emissions electricity – and only relies on the grid as backup power.

For their next data center in South Texas, they avoid the grid altogether and will instead drill for geothermal energy.

For companies at the forefront of this shifting landscape of industrial energy deficit, the message is clear:

The current trajectory of energy supply cannot meet the growing demand. This energy deficiency poses not just a challenge to operational sustainability but also to economic expansion and the broader move towards clean energy.

To navigate the energy deficiency facing the United States, companies with high energy usage are leaving the grid and turning to installing their own Behind-The-Meter energy generation systems.

Example of a Behind-The-Meter solar farm installation: Apple’s data center in Maiden (North Carolina). Click here to read the case study.

Read more about how energy-intensive companies are resorting to Behind-The-Meter solutions